PAN-Aadhaar Link Online: The government of India has extended the date to link a PAN with an Aadhaar Card. So all those holders who haven’t linked their PAN with their Aadhaar have to pay a fine of Rs. 1000 to link them. After the deadline, The PAN Card which is not linked with Aadhar will be treated as invalid. The PAN can be linked with Aadhaar from the Income Tax Department’s official website (eportal.incometax.gov.in) or by sending an SMS to a number announced by the government. You can continue reading the article to get more details about the PAN-Aadhaar Link last date.

PAN-Aadhaar Card Link last date

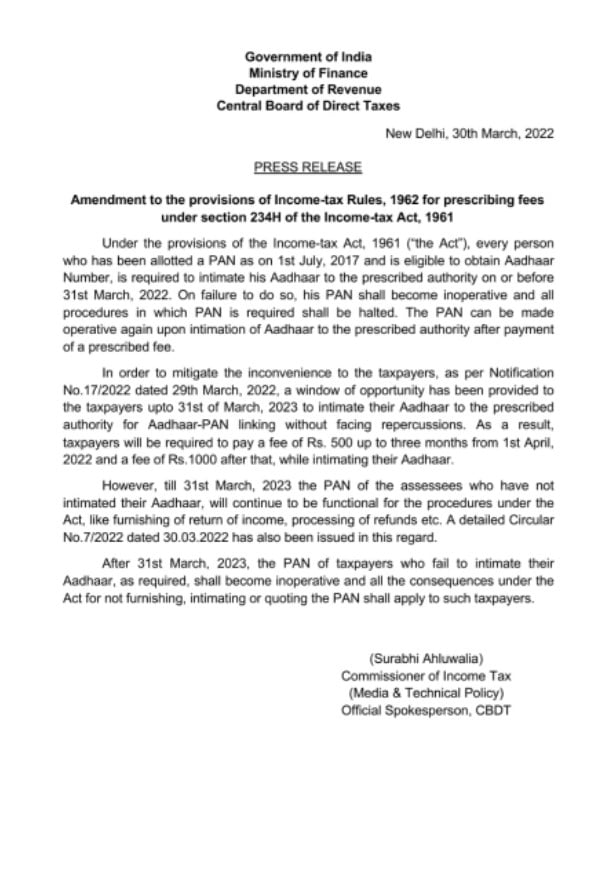

According to the press release released by the Ministry of Finance, if the holder fails to do the PAN-Aadhaar link then their PAN will officially get unserviceable and all the procedures in which the PAN is used will be ceased. The fine amount decided by the government is ₹500 up to three months from 01st April 2022 and ₹1,000 after three months while intimating their Aadhaar.

Recent data states that since the announcement around 43.44 crores of PANs has been linked with Aadhaar and over 131 crores of Aadhaar have been issued so far. The process will help in disqualifying duplicate PAN and depressing tax evasion. Keep reading this article, as you will get to know the PAN-Aadhaar Link highlights, benefits, and linking process.

PAN-Aadhaar Link: Highlights

| Ministry Name | Ministry of Finance |

| Department Name | Department of Revenue |

| Board Name | Central Board of Direct Taxes |

| Government | Government of India |

| Scheme | PAN-Aadhaar Link |

| Article Category | Article |

| Year | 2024 |

| Link Mode | Online & Offline |

| Eligible For | Indian Residents |

| Official Website | eportal.incometax.gov.in |

Benefits of linking PAN-Aadhaar

The benefits that which government, as well as Indians, will get after the linking process of PAN-Aadhaar will be concluded are:

- It will remove the possibility of individuals carrying more than one UIDAI Aadhaar Card.

- The Income Tax Department will be able to detect any form of tax evasion.

- The process of filing income taxes will become easy as the payer doesn’t have to show any proof while submitting the income tax.

- It will also help in maintaining the summarised data of individual taxes attached to the Aadhaar for future reference.

Check Your>>> PAN Card Status

Who are eligible to link PAN with Aadhaar Card?

To link PAN with Aadhaar Card, the user have to pass the eligibility finalised by the department and those are:

- He/She should be an Indian resident.

- The citizen should have a legitimate PAN and Aadhaar Card approved by the Indian government.

- They shouldn’t have more than one Aadhaar Card.

Process to link PAN-Aadhaar?

There are several methods through which you can link your respective PAN with the Aadhaar Card and those methods are explained in detail below:

Online Process:

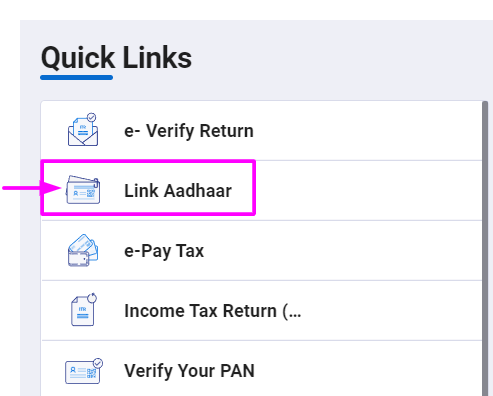

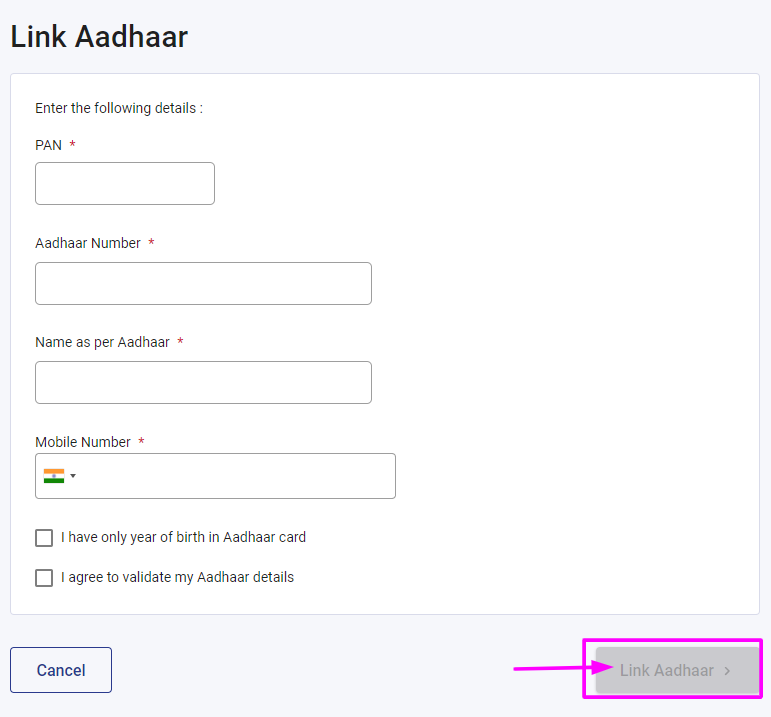

- Visit the Income Tax Department’s official website eportal.incometax.gov.in.

- Click the ‘Link Aadhaar’ box available on the left side.

- Now put forward all the details asked on the page, then click on the ‘Link Aadhaar’ box.

- A pop-up message of a successful link will be generated on your mobile number and on your system.

Offline Process:

If you aren’t able to understand the online process then don’t panic as IT Department has also provided the facility of linking the PAN-Aadhaar Card with the help of an application form, just follow these steps:

- Visit the nearest designated PAN Service Centre along with the downloaded form.

- Now fill up the details mentioned on the form and submit it to the officer available at the centre.

- Your biometric authentical will be done for cross-verification during the offline process.

- Make sure that you filled in all the correct information because once the form is submitted it will not be edited and you’ve to apply again by filling out the new form.

“You have a pay fee after arriving at Designated PAN Service Centre although the fee amount hasn’t been announced yet by the IT Department”.

SMS:

If you are finding the Online and Offline quite tough then you can conclude the PAN-Aadharr link by sitting at home only. You just have to send an SMS to ‘567678/56161’ and a notification about your PAN-Aadhaar link will come to your mobile number.

PAN Aadhaar Card Links

| Official Website | incometax.gov.in |

| Check Login Window | Login Link |

| Download | Application Form |