PAN Card Status, NSDL, and UTI PAN Application Status Online: In this article, we will talk about Checking PAN card status along with how to submit PAN application, PAN processing, checking PAN Application status through the NSDL and UTI portal, refund status of PAN using NSDL and UTI. So if you want to know everything about your PAN card then go through this article till the end.

NSDL e-Gov and UTITSL are the two entities given authority for PAN applications and processing them on the behalf of Income Tax Department (ITD). Both NSDL TIN and UTI provide the same kind of services related to PAN cards like checking PAN application status. Income Tax Department (ITD) has appointed these two entities for the purpose of getting and processing the PAN application forms and checking the pan card status.

PAN Card Status 2024

| Status | PAN Card application form Refund money status |

| Article Category | How to Check NSDL & UTI PAN Card application status online |

| Responsible Authorities | NSDL UTI Infrastructure |

| Parent Department | Income Tax Department |

| Official TIN website | https://www.tin-nsdl.com/index.html |

| Official UTITSL website | https://www.utiitsl.com/UTIITSL_SITE/ |

Let’s have a look at services provided by NSDL TIN and UTI-

| NSDL TIN | UTI |

| Paperless PAN application | PAN application |

| Aadhaar PAN linking | PAN application tracking |

| Online PAN application | PAN application centres |

| Know the status of the PAN/TAN application | PSA login |

| e-PAN download | PAN bulk verification |

| Online PAN verification | AO code details search |

| Information about PAN centres | New PAN or Correction service |

Apart from this, one can collect detailed information about PAN, application procedure, required documents, etc. through these web portals.

How to Check PAN Card Status Online?

After submitting the PAN application form, you all must be waiting for its issuance. Normally a PAN card can be generated in around 20 working days but now the officials have started the instant pan card facility in which a PAN card can be issued in 2 days. PAN card status can be checked on both NSDL TIN and UTI websites.

Below in this section, we will talk about the various and easiest ways through which you can check the status of your application.

Those who have applied through TIN they can track their application status through the given methods-

Application status for NSDL Users-

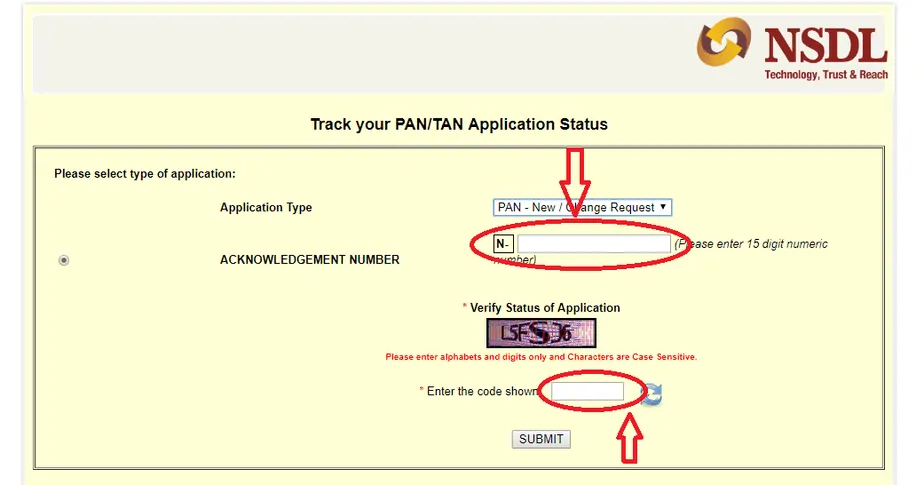

It is the most common and easy method of tracking PAN card status. You can check the procedure given below-

- Open the official site of NSDL – You have started by opening the TIN portal (https://www.tin-nsdl.com)

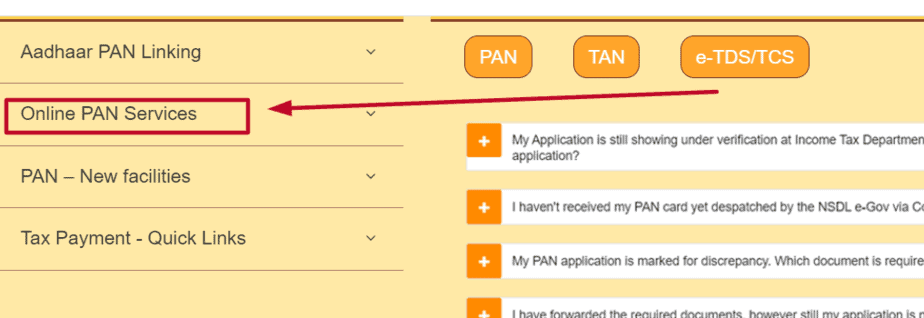

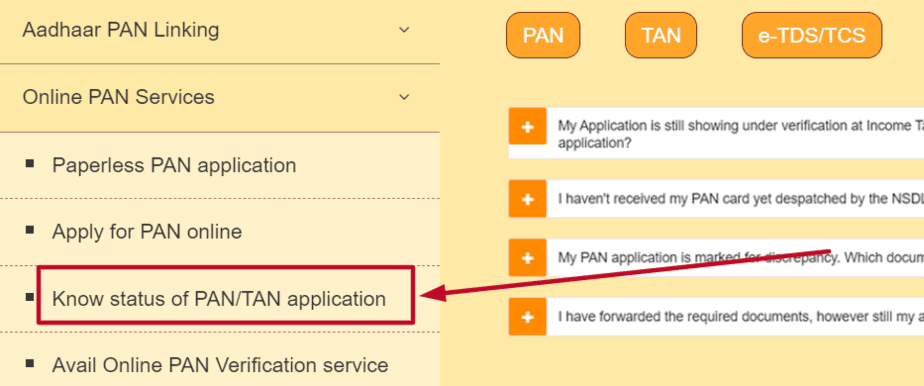

- Click on Online PAN services – Now on the home page of the portal select the Online PAN services tab.

- Select PAN/TAN Application status: Under the dropdown menu, you need to select the PAN/TAN application status.

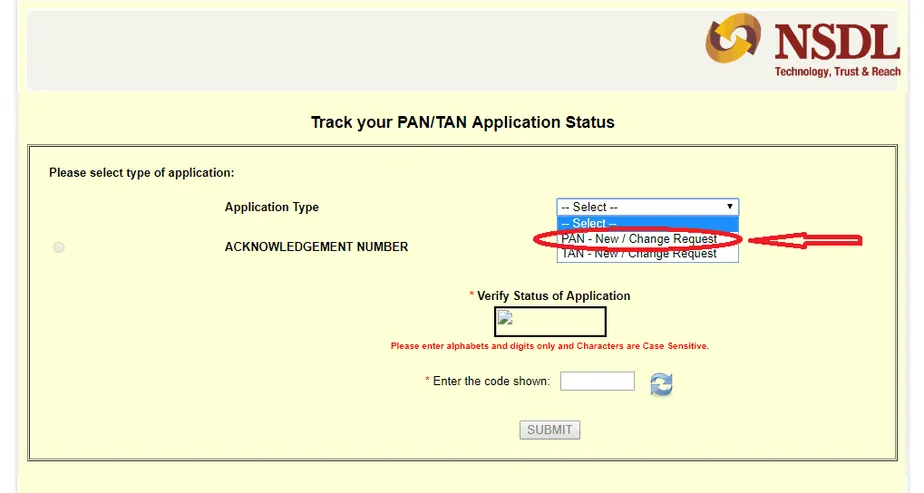

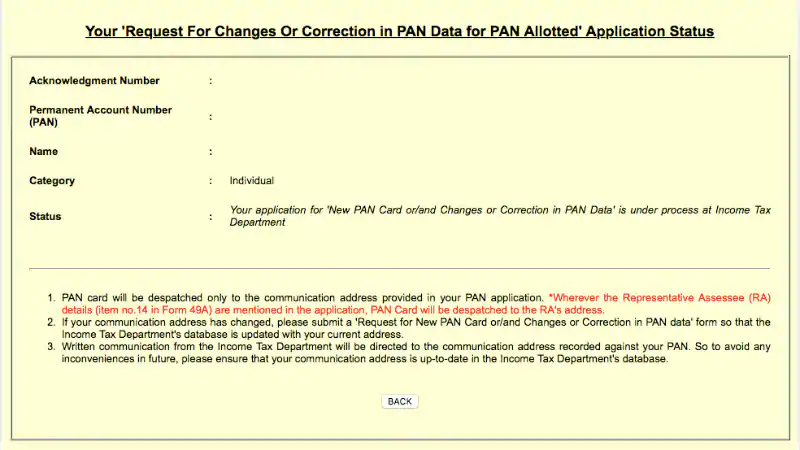

- Now select Application type – Application status page will appear. You have to select the type of application i.e. “PAN- New/ Change Request” option.

- Submit your 15-digit acknowledge number – By Entering the 15 digits acknowledge no. and code in the provided box.

- Click ‘Submit’ the request On successful submission, pan card status will appear. Hit the submit button and the Application status will appear on the screen.

Click here to know your NSDL PAN application status (Direct Link) https://tin.tin.nsdl.com/pantan/StatusTrack.html

How to check PAN Card Status without Acknowledge number?

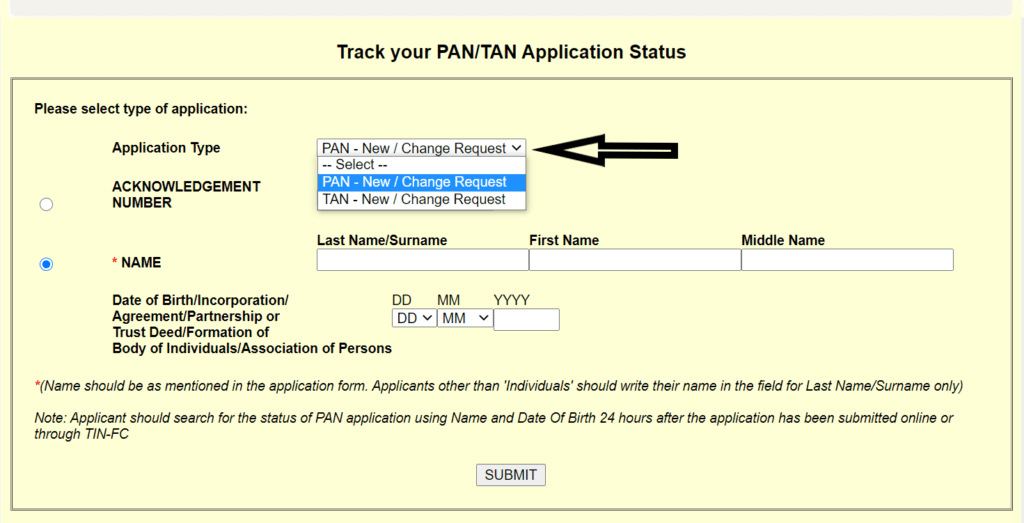

You can also check your PAN Card status without submitting an acknowledgement number and for that, you need to go through some steps which we have given below: –

- First of all, visit the Tin NSDL official website

- Now Select the PAN/TAN Application Status

- After submitting the same a window will open where you need to select the type of application from the dropdown menu which should be “PAN-New/ChangeRequest”

- Next, you need to submit your name (as submitted in the application form)

- Then, submit your date of birth

- On submitting the details press the submit tab

- and on pressing the same your PAN Card status appears on your screen.

UTI PAN Status for Users-

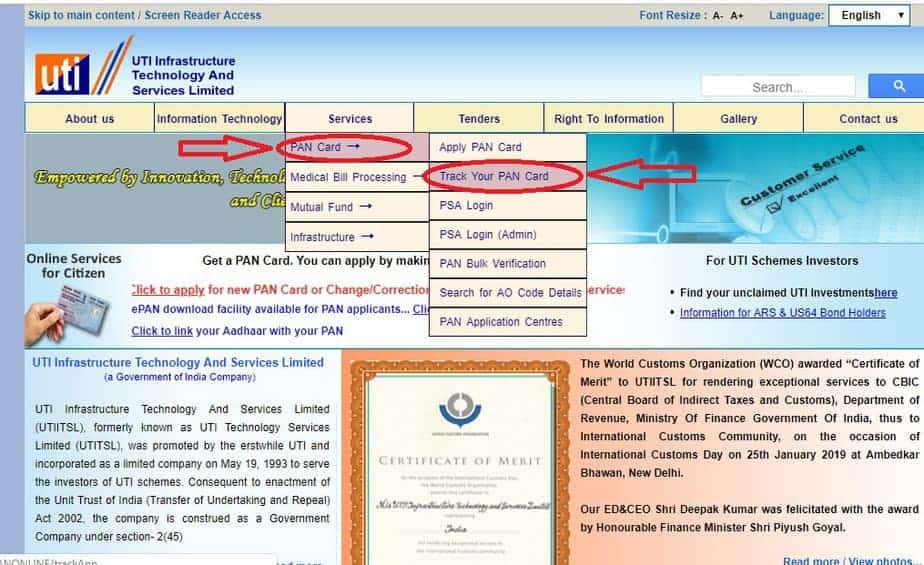

Step 1- If you have filled application for PAN using UTI then you have to visit the UTI official portal (https://www.utiitsl.com).

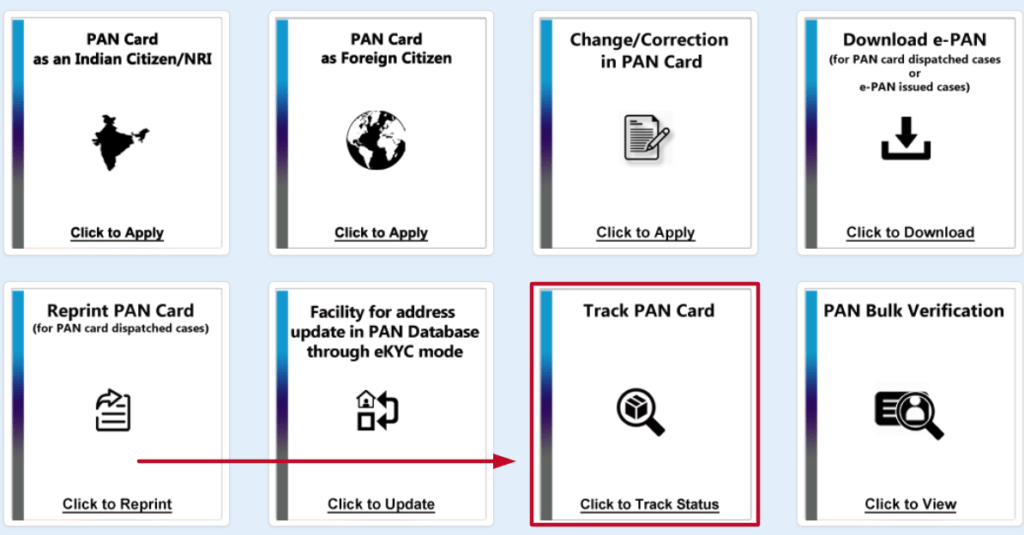

Step 2- You have to take the cursor to the “Services” menu on the top of the Homepage. Select the “PAN Card” option and click on the “Track your PAN card” link.

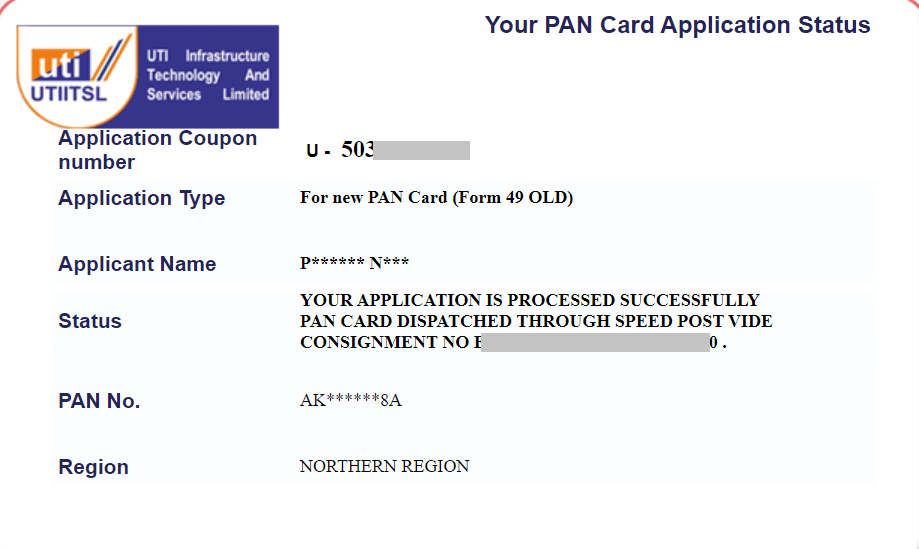

Step 3- Enter all the required details such as Application coupon no., or PAN number, date of birth, and captcha in the provided space. Click on submit button.

Step 4- After submitting the details, you can see the application status on your screens.

Through Coupon Number or PAN Number at UTI’s official website

You can check the status of your PAN card with the help of the coupon number which you received during the submission of the application form and it can be checked by following some steps which we have given below: –

- First of all, you have to Google UTI’s official website

- On reaching the portal you can easily see a tab mentioning “Track PAN Card”

- After pressing the same it will take you to a new page where you have to submit some of the details as available to you such as…

- Application Coupon number, DOB (as mentioned in the application form), and captcha code.

- After dropping all your details you need to press the submit tab.

- On Submission of details, your PAN Card status will appear on your screen.

How to check PAN Card status through SMS?

Now it was so easy to check the status of the PAN card by just sending an SMS from your mobile number but this facility can avail only after three days of submission of the application and for this method, you need to send the text in a requisite format whose details are mention below and within a minute your PAN card status will appear to you.

For this, you have to type- <NSDLPAN 15 digits Acknowledgement No.> and have to send it to 57575 to obtain your application status.

Eg.- NSDLPAN XXXXXXXXXXXXXXX

PAN Card Status through E-mail

To obtain your pan card status you have to send an email to tininfo@nsdl.co.in. You must mention your acknowledgement no.

PAN Card Status through call

PAN Card Status can also be checked by making a call it is one of the simplest ways you can opt to check the status of your PAN Card and for this, you need to call the PAN Call Centre at 020- 2721-8080 and by following their instruction you need to submit your 15 digit Acknowledgement number.

PAN Status Through Fax

Fax is another medium to track the PAN application status. You can fax your status request with the correct acknowledgement no. at 020- 2721-8081.

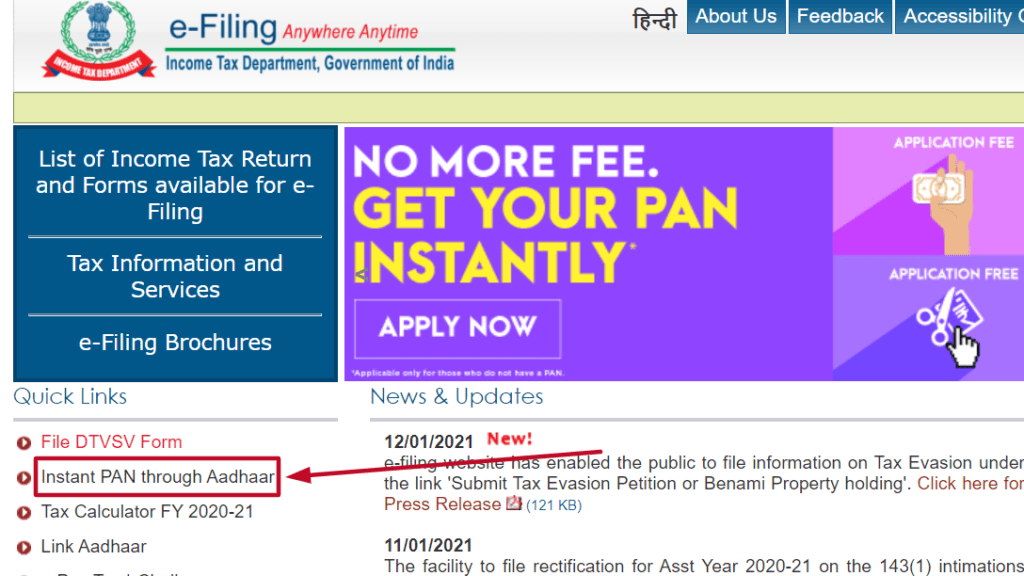

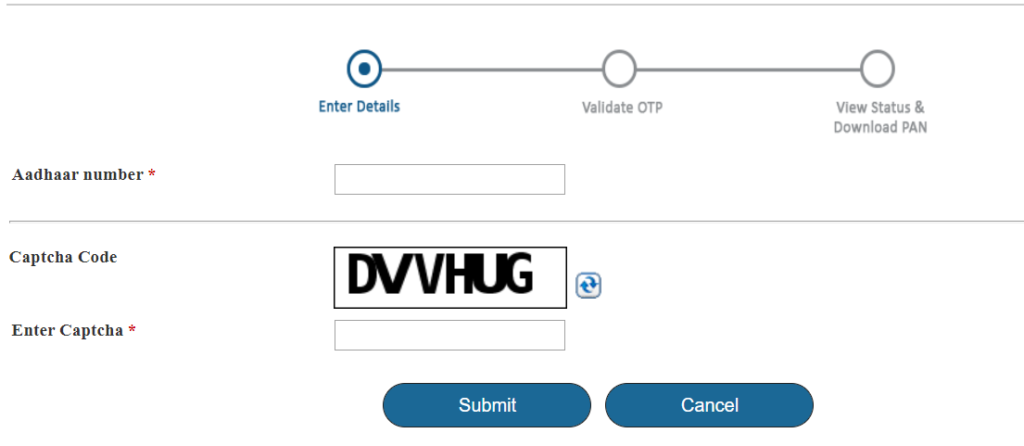

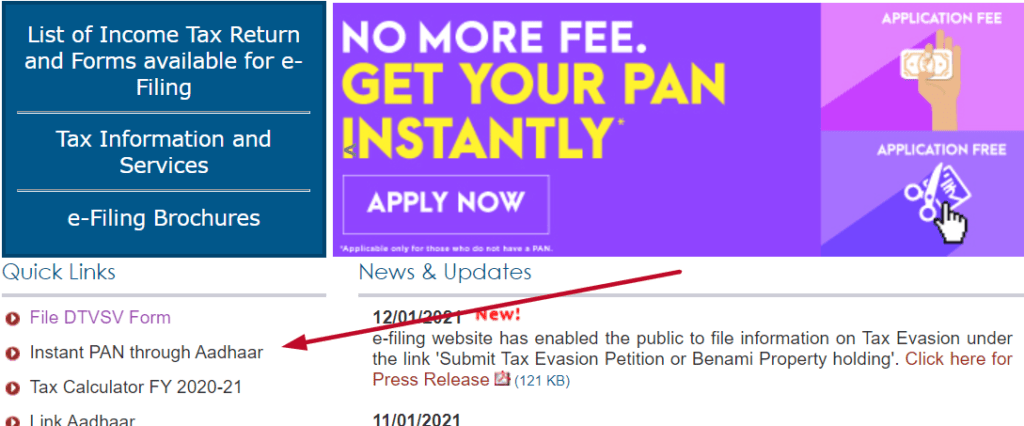

How to check PAN Card Status allotted through Aadhaar Card?

If you had submitted the PAN card paper-less application through an aadhaar card then it can be checked by following the steps that we have given below: –

- First of all, visit the https://www.incometaxindiaefiling.gov.in/home

- Now on the home page of the website, you need to click on the “Instant PAN through aadhaar“

- After selecting the same a window will open where you need to select the “Check Status/Download PAN”

- After selecting the same you need to submit your aadhaar card number and captcha code as appears

- After submitting this an OTP will be received on your registered mobile number which you need to validate.

- After validating the OTP your Paperless PAN Card status will be available to you.

In this case your mobile number must be linked to that aadhaar number

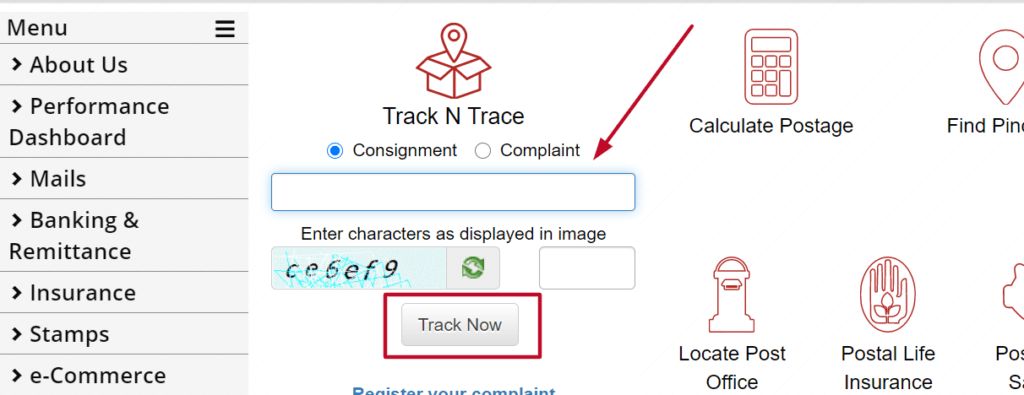

How to track PAN Card Delivery Status?

While checking the PAN card application status if it was showing that your PAN card has been dispatched and a message for the same has been received on your registered mobile number but now it’s been quite a few days and still your PAN card is not delivered, in that case, you can check the status of the delivery by following some steps which are given below: –

- First of all, visit the India Post official website

- Now on the home page of the portal, you can easily see the “Track N Trace” section.

- In this, you need to submit the consignment number as received on your mobile number or also in Email.

- Submit the code appears and press the track now tab.

- After pressing the same the delivery status of the PAN card will appear to you.

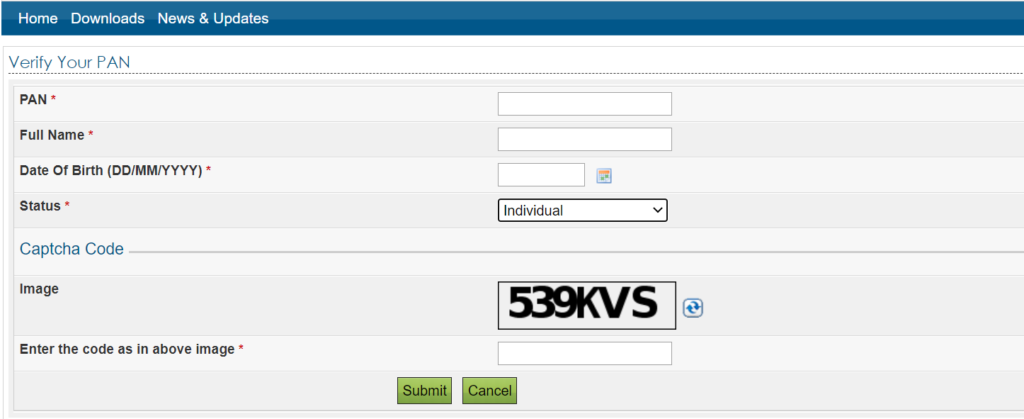

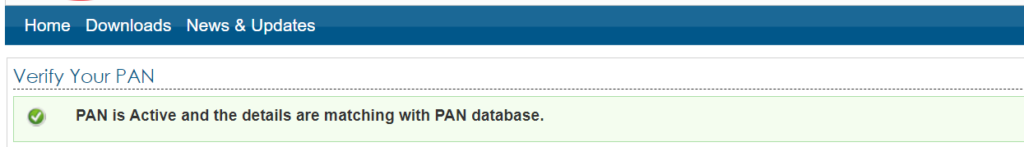

How to know whether your PAN Card is active or not?

Now it was so easy to check whether the PAN Card you are owning is active or not and it can be done easily by visiting the official website of income tax e filling India official website whose steps are given below: –

- Visit the https://www.incometaxindiaefiling.gov.in/home

- Now on the home page of the portal select “Verify PAN card details“.

- After selecting the same it will take you to a new page where you need to submit some of your details like

- PAN Number, name as appeared on the PAN Card, Date of birth, select the status of the PAN card from the dropdown, and finally enter the Captcha code that appear on the screen.

- As you submit the details the status of the pan card will appear on your screen

How to link Aadhar to PAN?

As per the guidelines of the Income Tax Department, it is compulsory for all taxpayers to link their aadhaar card with their PAN card.

Linking of Aadhaar to PAN can be done online. You can follow the given steps to get your PAN linked with your aadhaar-

There are two ways through which you can link your aadhaar card to a PAN card one is online or the second one through SMS. In the section given below you will get to know its stepwise process:

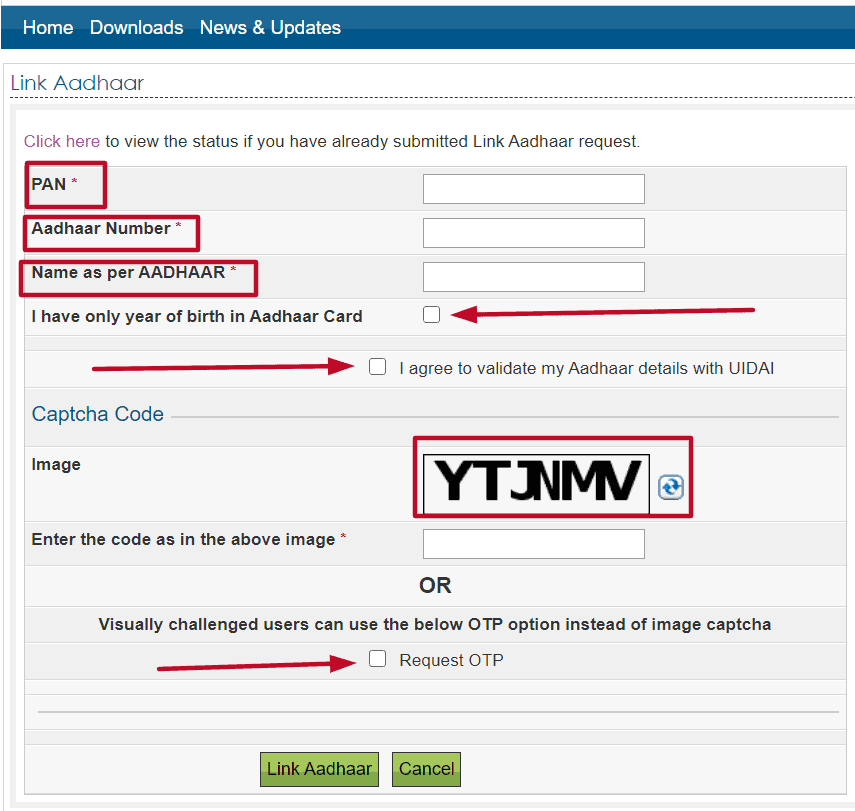

Through Official Website

- In order to link an aadhaar card with a PAN card you need to first visit the official website of https://www.incometaxindiaefiling.gov.in/home

- Now on the home page, of the portal, you need to select the “Link Aadhaar” tab.

- After selecting the same a page will appear to you, in this, you need to…

- Enter your PAN & Aadhaar number (as mentioned in your respective card)

- After this enter your name as mentioned in the Aadhaar card

- In case, your aadhaar card possesses only the DOB year, then you need to tick the check box.

- Tick the box mentioning validate my aadhaar details with UIDAI

- After this enter the code as mentioned in the Image

- Those who are visually challenged can opt for the OTP option.

- After doing such steps press the link aadhaar button.

While linking aadhaar with PAN make sure that both cards hold similar details in case there is any mismatch between the two then your linking process will not be successful. If you want to make any changes to your existing PAN card then it can be done online whose details are given below.

Through SMS

You can also link your aadhaar card with your PAN card by just sending a text message from your mobile number. In order to do the same, you need to type the message in the right context whose details were mentioned below: –

UIDPAN<space><Your12digit Aadhaar><space><your10digitPAN>

You can send SMS to 56161 or 567678 from any mobile no.-

Example: UIDPAN 123456789121 XYZAB1234A

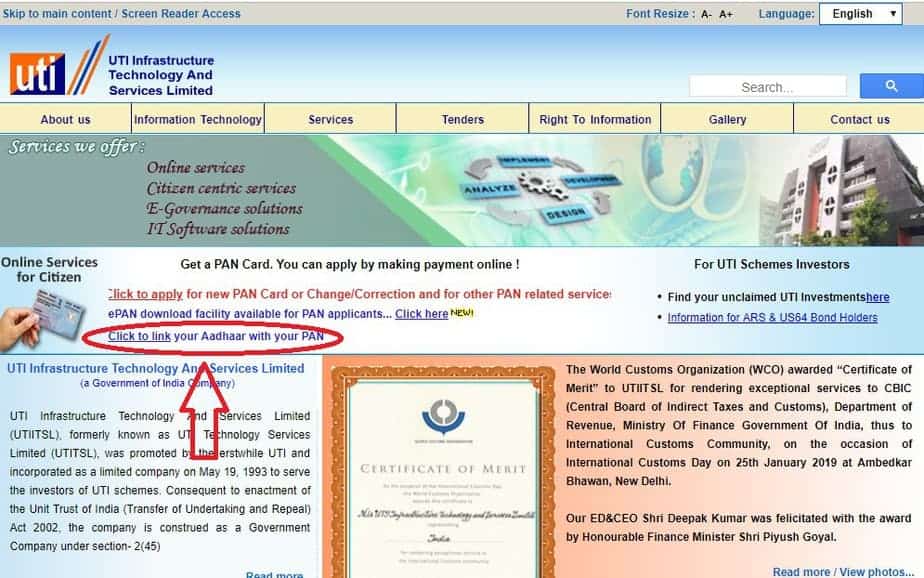

Aadhar Card can also be linked from the UTI official website whose process is similar to the one we mentioned above.

- Visit https://www.utiitsl.com

- On the homepage of the website, you have to click on the “Link your Aadhaar with your PAN” link.

- You will be redirected to the Aadhaar linking page. You have to enter all the required information.

- Lastly, click on “Link Aadhaar”. Aadhaar will get linked to your PAN.

Are you still unable to link your PAN with your aadhaar? Check what to do

As you all know that GOI has clearly mentioned that it was mandatory for all PAN cardholders to link their Aadhaar card with their PAN card. But still, there are some people who haven’t linked it yet. But there are some people who are not able to link it because of discrepancies in their cards. But such discrepancies can be corrected by visiting their respective portal. In case, if your PAN Card required some correction then it can be done by following the process which is given below: –

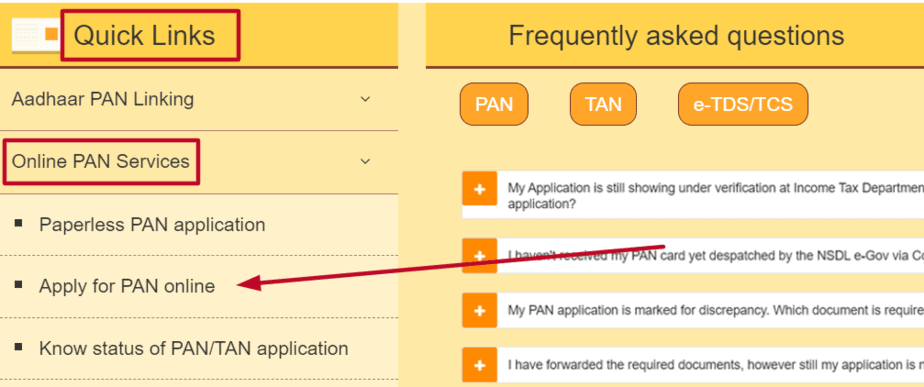

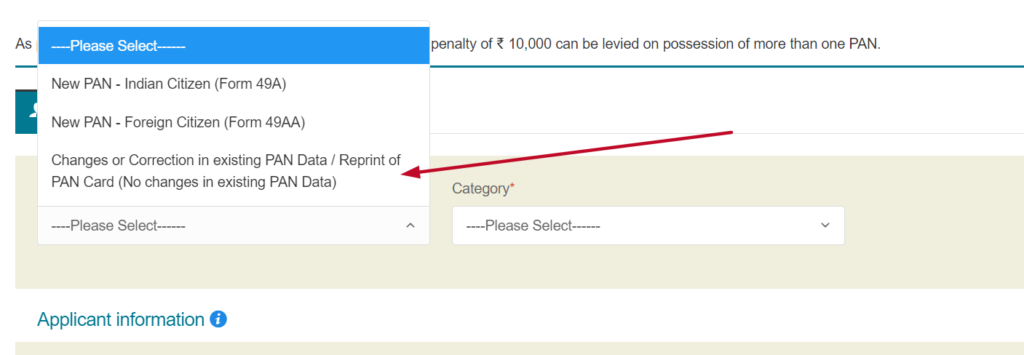

How to make corrections to the existing PAN card?

PAN Card correction or update is now easy for users because now it can be done through online mode by following some simple steps: –

- Firstly, visit the official website of NSDL

- Under the quick link section on the home page select “Online PAN Services” and in the dropdown select Apply PAN Online.

- On the next page, you need to click on the “Apply” Link

- Now under the Application type, you need to select “Changes or correction in existing PAN Card“

- Now submit the details as mentioned in it and submit your documents digitally

- Once the details have been corrected by the official you will receive an email regarding the same and later you can link your PAN card with your aadhaar easily.

How to check whether PAN Card is linked to an aadhaar or not?

The PAN card to aadhaar linking process usually takes 2 to 5 working days and if you have completed the linking process and wanted to know whether your card is linked successfully or not, then it can be easily checked online by simply following some steps that are furnished below:

- Visit the https://www.incometaxindiaefiling.gov.in/home website

- On the home page select the “Link aadhaar” link.

- On the new page, you need to select the “Click here” link in order to know the status.

- After selecting it, a page will open where you need to enter your Aadhaar number and PAN number in their respective boxes.

- On submission press “View the aadhaar status” and the status of the same will appear to you.

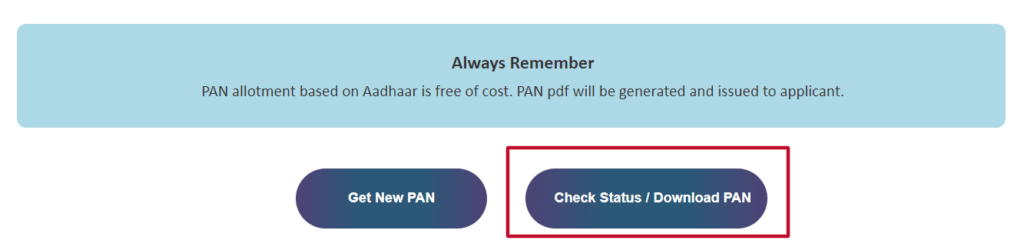

How to apply for an Instant PAN card?

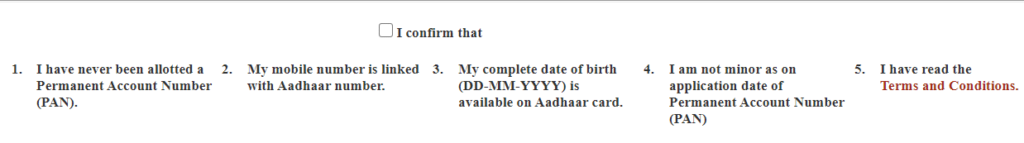

Instant PAN Cards will be allotted to those applicants who possess valid aadhaar card and such PAN card is issued in real-time and in PDF format which is free of cost.

Points to keep in mind before applying: –

- Applicant must have a valid aadhaar card and it should not be linked to any other PAN card.

- Mobile numbers should be registered with an aadhaar card.

- Its process is paperless so no physical application form or documentation is required.

- Applicant should not hold another PAN card.

Instant PAN Application process

- First of all, visit the https://www.incometaxindiaefiling.gov.in/home official website

- Now on the home page select “Instant PAN through Aadhaar”

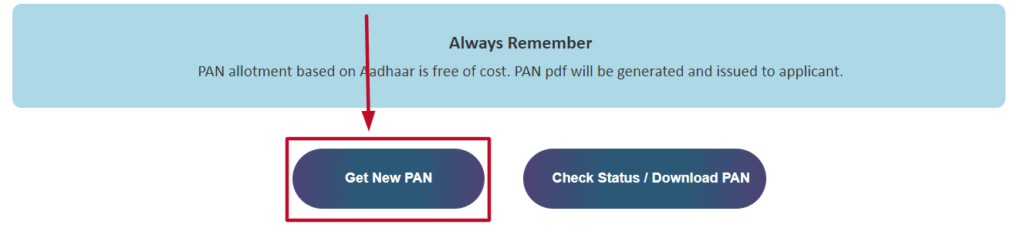

- On the new page, you need to select “Get New PAN“

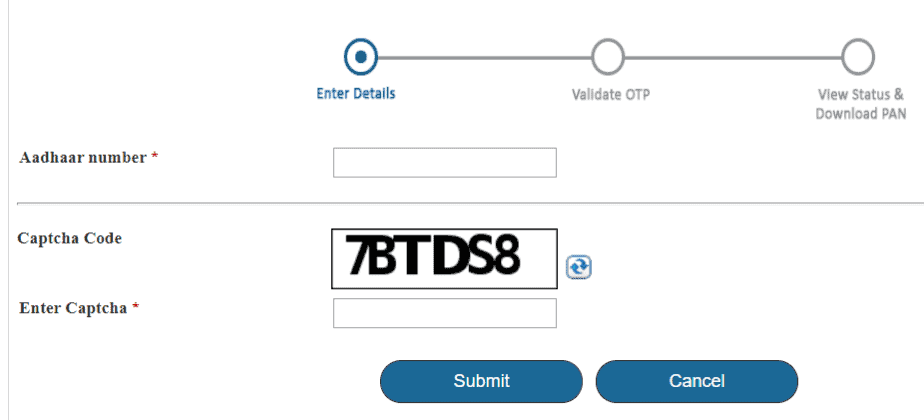

Enter Aadhaar number: After this, a page will appear where you need to enter your aadhaar number along with the captcha code that appears on your screen.

- and before proceeding, do confirm the details which were mentioned below and…

- Press the generate Aadhaar OTP tab

- Validate OTP: Once you received the OTP on your registered mobile number validate the same on the portal.

- Validate aadhaar details: Now later you need to validate your aadhaar details.

- Validating Email Id is optional you can skip it if you do not want to validate it.

- and on successful submission applicant will receive an acknowledgement number (15 digits) which can be used to check PAN card status.

How to Download Instant PAN Card?

After submitting the application for an Instant PAN card you can download the same from the official website whose process has been discussed below: –

- Visit https://www.incometaxindiaefiling.gov.in/home official website

- Select the Instant PAN card link.

- On the other page, you have to select Status/Download PAN

- As you select the same you need to enter your aadhaar number and captcha code.

- and OTP will be received for the authentication which you need to validate

- after validating the same you can easily see the status of your PAN card and if your PAN is allotted…

- then you can download its pdf file from there itself.

How To Download NSDL OR UTI E-Pan Card?

Now, e-PAN is also available now and it will be a valid mode of the issue of Permanent Account Number (PAN). Users who have applied for e-PAN can download their e-PAN from both NSDL and UTI.

- E-PAN card download through NSDL portal-Under this, NSDL provides two e-PAN download options viz.

- Download e-PAN card (for PAN allotted last month) – Here, enter the acknowledgement No. and captcha code for logging in. Click on submit button and follow further instructions (if any). e-PAN download link- https://www.onlineservices.nsdl.com/paam/MPanLogin.html

- Download e-PAN card (for PAN allotted before one month) – Those who have been allotted their PAN before one month can click on the link shared below- https://www.onlineservices.nsdl.com/paam/ReprintDownloadEPan.html

- Enter all the details such as PAN, Date of Birth, Month of Birth, Year of Birth etc. Follow all the instructions provided further and download your e-PAN.

- E-PAN download via UTI –If you are registered with UTI you have to download your e-PAN from its official website only. The download procedure is as follows-

- Go to https://www.utiitsl.com/UTIITSL_SITE/#

- Click on the “ePAN download facility available for PAN applicants” link.

- Open the “Click here” option.

- You need to read all the instructions provided on this page. Once you have read all the instructions, enter all the required credentials.

- It is compulsory to fill in all the marked fields. After submitting the details, download your e-PAN.

How to Apply for PAN Card?

Applicants can apply for PAN through both online and offline mediums. For offline mediums, applicants can either download the PAN application form from the official website or can obtain it from the authorized PAN centre.

For online PAN applications, you can either apply from NSDL TIN or UTITSL. To help you with this we have shared both application procedures here-

NSDL TIN PAN application-

- You have to start by opening the official TIN website.

- If you are an Indian citizen, then you have to fill out Form 49A and if foreigner then needs to fill out Form 49AA.

- Find the PAN card option and click on “Apply”

- You will be redirected to a new page and an application form will be displayed.

- Fill in all the details and click submit.

- Choose the AO code and select your state and category.

- Submit POI, POA, and Proof of Date of Birth.

- Make the payment.

- After submission of the application, your PAN card will be couriered to you. You will be given an acknowledgement no. for tracking the application pan card status.

- Application link (for Indian citizens)- Form 49A Online | Form 49A PDF link

- Application link (for foreign citizens)- Form 49AA Online | Form 49AA PDF link

- Application and sign using DSA (for Indian citizens)- Apply Here

- Application and sign using DSA (for foreign citizens)- Apply Here

UTI PAN application-

- Visit https://www.utiitsl.com/UTIITSL_SITE/pan/index.jsp

- Click on the “PAN” options provided under the menu services.

- Select the relevant options and follow the instructions and fill information accordingly.

- Provide all the details and documents.

- Make a payment.

- Submit the application

- You will receive an Application coupon no. This no. is used to know the pan card status.

PAN Application Fee

The application fee is specified by the Income Tax Department. Whether an applicant applies offline or using NSDL or UTI platform, he/she has to pay the standard application fee specified by ITD for that particular application category.

Mode of payment-

- Online (credit/debit card and net banking) and applicants can also make payment through a Demand draft drawn in favour of ‘NSDL-PAN’ that will be payable at Mumbai.

How to search for PAN centres?

- Those who want to search PAN centres in their location. People can also apply for a new PAN from these PAN centres established at various locations in the country. They just have to visit their nearby PAN centres and have to provide the necessary documents. They can search their nearby centres with the help of the internet.

- In order to search the PAN centres using the NSDL portal, you can click on https://www.tin-nsdl.com/pan-center.html and find your nearby PAN centre. You have to select your state/ union territory and location.

- If you have filled out your PAN application using UTI, you have to visit https://www.psaonline.utiitsl.com/PanCenters/applicationCenters and have to select your state and location.

How to check PAN Card Refund Status?

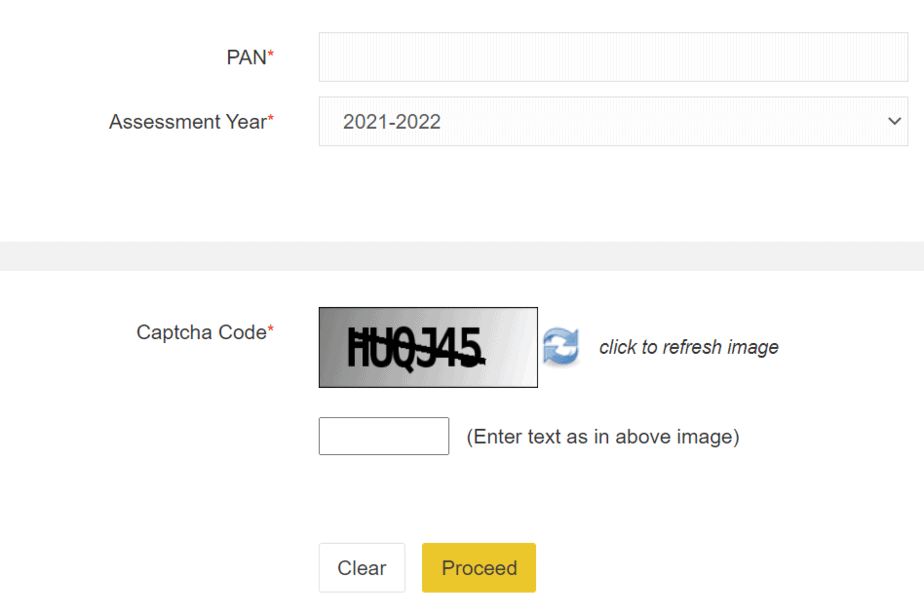

You can also check your PAN refund status in case you have applied for a refund. To track your refund status through NSDL, you can click on the link provided below. https://tin.tin.nsdl.com/oltas/refundstatuslogin.html

You just have to enter PAN, assessment year, and captcha code. Click on proceed and your status details will appear.

Online PAN Verification

The registration link for online verification through TIN- https://onlineservices.tin.egov-nsdl.com/TIN/inputPageForPanInqDetails.do

New PAN Card & Its Features

Income Tax Department is now issuing new PAN and e-PAN cards with new designs. ITD has been issuing these newly designed PAN cards since 7th July 2018. Check the features of new PAN cards shared below-

- The position of the dimension of the QR code, photograph, signature, and hologram has been changed.

- A new PAN card is coming with an enhanced QR code. It will contain the PAN applicant’s photograph and signature apart from the existing information i.e., PAN, Name of the applicant, Date of Birth/Incorporation/Formation, Father’s Name/Mother’s Name. This aforementioned information is digitally coded and signed on the Enhanced QR code.

- The enhanced QR code will be readable by specific Mobile applications (App) which are available on Google Play.

- This enhanced QR code will also be made available on e-PAN cards.

The most important thing that every citizen should know is that PAN cards and e-PAN cards of old designs issued before 7th July 2018 will also remain valid. No, the authority can deny accepting these old PAN cards (wherever PAN is required).

If you have any questions related to pan card status NSDL/UTI then comment below. Our team will help you get your PAN Card status.

FAQs

A permanent Account Number is a 10-digit combination of alphabets and numbers used as an identifier issued by the Income Tax Department. Each individual, company, firm, etc. are issued a unique PAN.

Any person, taxpayer, or assessee who is liable to pay income tax even on the behalf of others is required to have a PAN card. Apart from this, any individual intending to enter into financial or economic transactions wherever PAN is mandatory must have a PAN card.

Detailed information on all the documents required for PAN application can be collected from https://www.tin-nsdl.com/services/pan/documents-required.html

Yes, it is compulsory for all PAN cardholders (who have to file ITR) to link their PAN to their Aadhaar positively by 31st March which can be done easily from the income tax official website or also by just sending an SMS from your mobile.

Yes, e-PAN is a valid proof of PAN which contains the QR code which holds the demographic details of the users such as their name, DOB, Photograph, etc. which can be checked from an OR code reader.

PAN application, eligibility, document requirements etc. are specified by ITD and thus it is similar and is followed by both entities. The application fee is also decided by ITD and therefore it is also the same for both the mediums unless ITD makes changes to it.

You will receive your e-PAN in a PDF form in your registered e-mail ID (i.e. the ID you have mentioned on the application form).

It takes normally two weeks for the processing of the application and dispatch of PAN provided details mentioned in the application are correct and in order in all aspects.

No, a penalty of Rs.10,000/- is levied on possession of more than one PAN as per Section 272B of the Income Tax Act., 1961.

You can track the pan card status of PAN by using the acknowledgment no./ application coupon no. You can also contact your PAN centers. In case of delivery, you will receive a message or email on your registered mobile no. and email ID.

PAN inquiry no.- 033-40802999

Toll-free Number: 1800220306

020-27218080

No, those who are already possessing the PAN cannot apply for e-PAN card. As you know possession of more than one PAN card is against the rule and a penalty of 10,000 can be levied on such a person.

Aadhaar based PAN is an instant PAN allotted to the applicant in real time. To generate the same applicant must possess a valid and active aadhaar card.

Yes, of course, it is valid. however, such PAN card is paperless and can apply online without paying any application fee.

No, those who applied for Instant PAN card will not receive any physical card instead e-PAN will be issued to them.

If your PAN Card application status is showing status under verification at income tax department then, in that case, you may contact on TIN helpline number which (020)27218080 and by this, you may get to know the reason for delaying.

As your PAN Card has been dispatched then you can track its status from the courier partner website or from the link that has been shared on your registered mobile number.

PAN number can also be checked on the allotment letter which was sent to you or also at e-mail received. But in the absence of both, you may contact the helpline number at 1800 180 1961.