Salary Slip: A salary slip is an essential document in terms of financial management. The slip is required for multiple purposes pertaining to income and administration. Additionally, the document becomes crucial when filing for Taxes and more. Most of the salaried employees are offered a salary slip. However, a very large number of these employees are unaware of the various aspects and importance of the salary record statement.

Further, the payslip is offered in a particular format or template. It is important for the receiver and recipient to use the correct format of the statement. In the following article, we have provided all the necessary details regarding the Employee Salary Slip. Read thoroughly and gain information that you must know.

What is an Employee Salary Slip?

An employee salary slip or payslip is simply a document that the employees are issued by the employer which contains all the essential break-up and information of the salary that is being paid. The statement lists all the entities of the salary such as Basic Pay, Scale, Allowances, and others. Further, they also provide insight into the bonus scheme, additional bonuses, penalties, depreciation, and increment.

The record slip is limited to a particular time period. For instance, the document issued can be for a month or a quarter. In case the salary slip is not issued to you by default, you can also request it from your employer as per your requirement and for the desired time duration.

Looking for AIMS Portal: RESS Salary Slip

Importance of a Salary Record Statement

Before you request or receive your salary statement from the employer, you must know what difference it could make and what importance it holds. The document is highly crucial for financial benefits and administration. Check the ensuing information regarding the need of having a salary slip:

- Payment Income Tax: In very simple words, a Salary Record Statement is proof of one’s income from a single and prominent source of income. The year accumulation of the record of the salary statement reflects what a person earns in a fiscal year and how much tax is applicable to them. When filing for Income Tax Returns or ITR, you need to submit the statement. If you are a salaried employee, you cannot omit this step.

- Income Tax Rebate: When you apply for the submission of income tax as per the old system, you need to submit the payslip in order to obtain the tax rebate as applicable. It will be extremely difficult to receive any discounts or relative benefits if you do not produce the respective record document.

- Necessary Document for Availing Benefits Offered by Various Organisations and the Government: There are multiple benefits of having a payslip and one of them is the submission of the slip in order to obtain a subsidy or benefits offered by organisations or the government. In order to apply for schemes offered by the government and philanthropic organisation and their wings, you need to furnish completely detailed proof of your income as the authorities shall only consider you eligible on the basis of the income slab fixed by them.

- Employment Evidence: A salary payslip is proof of employment of a candidate. If you need to apply for a certain job, admission, position, or any other, you will be required to submit evidence of employment. This is when the statement record becomes handy. As you submit the proof you shall be applicable for respective conditions.

- Loan Application: While applying for a loan, one needs to submit the income slip so as to produce proof of earning. Thus, the salary slip provides an insight into the monthly earnings of the applicant helping the bank or the lender to get an idea as to how much the payee will be able to repay in what interval of time.

- Salary Estimate: For the personal understanding of the enterprise, professional, or new company where the professional has applied, the payslip is extremely necessary. The entity can idea of what the salary is and how much the yearly earnings are. In case the professional has applied to a new firm, they will be able to negotiate salary on the basis of what was initially offered to them.

Check UP Police Salary Slip

Salary and its Component

Salary is the monetary earning that an employer pays to an employee in exchange for work done by them for the firm. The salary is usually paid on a monthly basis while in some cases, the payment can be made in a weekly manner. The salary of an employee is paid while including the ensuing components or considering the relative factors:

- Basic Pay is the amount of money that needs to be paid to the employee as per the work submitted by them.

- House Rent Allowance is paid on the basis of the location of the job, and the general house rent of living expenses estimation, the authorities pay the employees.

- Dearness Allowance is the amount that has to be paid to the workers to reduce the effect of inflation that they can face.

- Travel Allowances are applicable to employees who might be required to travel for work or sometimes even for a personal reason and the company wishes to support them.

- Medical Allowance is paid to employees in many firms in order to support them during tough medical conditions.

- A Bonus also makes up part of salaries and they can be work or festivity related.

- Provident Funds or PF of various kinds are deducted from the salaries.

- TDS or Tax Deductible at Source is the income tax that is directly paid by the employer on the behalf of employees.

- Taxes are also deducted from salaries but this depends on the policy of the respective firm.

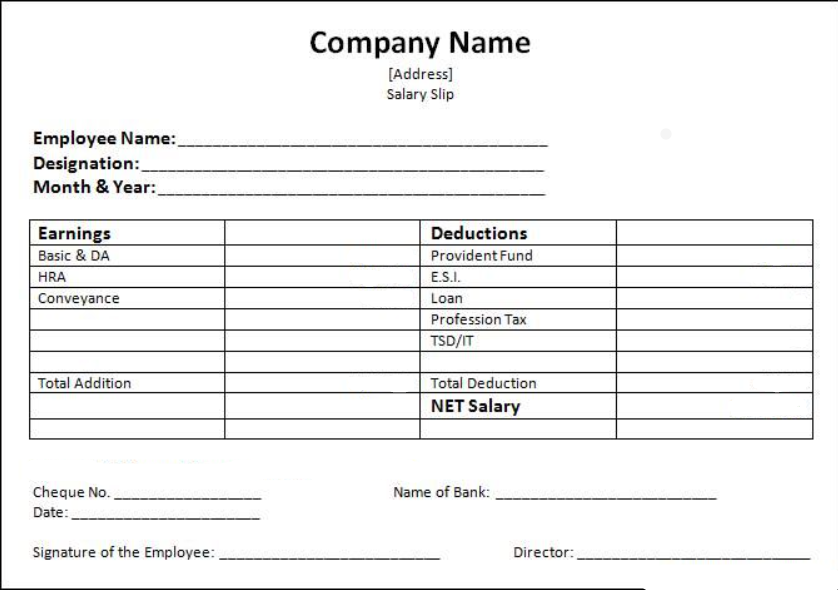

Salary Slip Format

The following will be mentioned in the payslip as per the format:

- Name of the Company

- Address of the Company

- Name of the Employer

- Employee’s Name

- Address of the Employee

- Date of Issue

- Month or respective duration

- PAN Number of the Employee

- Break up of the salary

- Total Salary

- Attendance Details

Sample Template for Payslip