PF Balance: Employee Provident Fund (EPF) or also known as Pension Fund can be defined as “A fund in which a small portion of an employee’s monthly salary gets deposited into their respective PF account with the motive to safeguard their future”. The Employee Provident Fund Organization (EPFO) is responsible for the regulation and management of the Provident Funds in India. The PF is controlled under the supervision of the Central Government. To clear the concepts about the PF Balance read this article till the end or go to EPFO’s main portal epfindia.gov.in.

PF Balance

The EPF is a scheme that came into existence to secure a better future for employees. It’s a benefit that is available when the employee leaves their services or is about to get retired. In the case of the deceased employee, the benefits of the PF are given to their nominees and both employee and the employers have to make their individual contributions towards the provident fund. The first company that opted for the concept of a Provident Fund is Jamsetji ‘Tata Group’. Keep going through the article and you will be able to collect more facts about the Provident Fund Balance.

Provident Fund Balance: Glance

| Organization Name | Employee Provident Fund Organization (EPFO) |

| Scheme Name | Provident Fund (PF) |

| Category | Scheme |

| Status | Active |

| Beneficiaries | Indian employees |

| Availability Mode | Online & Offline |

| Official Website | epfindia.gov.in |

Benefits of Provident Funds

The several benefits which the employee can get from their Provident Funds are as follows:

- The employees can take advances or make withdrawals.

- The PF amount of the deceased employee is payable to their nominees.

- The employers not only contribute towards the Provident Funds but also make necessary contributions towards their employee’s pensions.

- EEE (Exempt, Exempt & Exempt) tax under the Income Tax Act enables tax-free returns to the employees.

- Employees receive extra income from their savings in the form of interest.

- The employee doesn’t have to create another PF account if they switch job.

EPFO Schemes

There are three schemes that are operated by the authorities of the Employee Provident Fund Organization (EPFO) and those schemes are:

- Employee Provident Fund Scheme 1952: The scheme provides the accumulation plus interest upon retirement and death. Partial withdrawals for marriage, education, illness and house construction.

- Employee Pension Scheme 1995: EPS will give monthly benefits for retirement, disability, survivor, widower & children. Past service benefit to the employee of erstwhile Family Pension Scheme1971.

- Employee Deposit Linked Insurance Scheme 1976: The benefit provided for employee death who was a member of the scheme. As per the revised scheme, the nominee will get a benefit amount 20 times of the wages or based on the deposit in the Provident Fund.

EPFO Vission

The vision seen by the Employee Provident Fund Organization can be read below:

- To meet the needs of social security in a transparent, contactless and paperless manner.

- To make sure Nirbadh services with multi-locational and auto claim settlement process for disaster proofing EPFO.

- To ensure ease of living for members and pensioners, and ease of doing business for employers by leveraging the Government of India’s technology platforms for reaching out to millions.

Nominees for the Employee Provident Fund

To get the benefit of the EPF, the employee has to choose a nominee whose details are given below:

- If the member is married, they have given the name of their spouse and children in the prescribed form.

- The member can nominate any one or more of the family members.

- If the member doesn’t have any family members can nominate any other person whom they trust.

- However, that nominee will not be considered if the member gets married.

How do you check the PF Balance from the EPFO’s official portal?

- Move to EPFO’s main portal i.e. epfindia.gov.in.

- Under the drop-box of ‘Services’ select the ‘Employees’ option.

- After selecting that option, you’ll be redirected to a webpage. Then under the column of ‘Services’ select the ‘Member Passbook’.

- On a new page, enter your Universal Account Name, Password, and Captcha, then press on ‘Login’.

- Your new web page will be showing your Provident Fund balance on the computer screen.

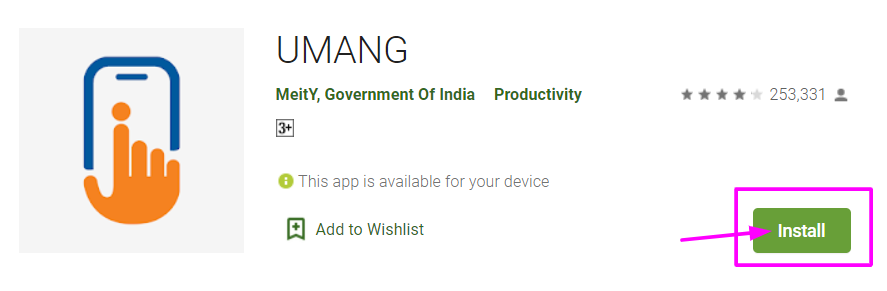

Procedure to check EPF Balance via Umang App

- To check the Provident Fund Balance via the Umang app candidates have to first download the app by opening the Play Store and searching for ‘UMANG’ then press on ‘Install’.

- After the app gets installed on your mobile phone open it and choose the language according to your preference then read the Terms & Conditions and then tap on the ‘Next’ button.

- The EPFO tab will get open and register through One-Time Registration.

- After getting registered, tick on ‘View Password’ and then enter the UAN and OTP.

- Then press on the ‘Submit’ option and you’ll see your Provident Fund details on your mobile screen.

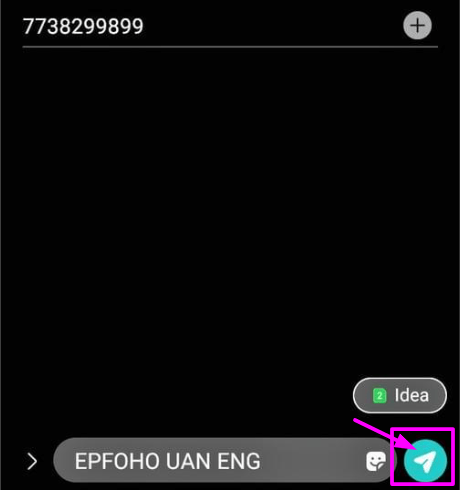

Steps to Check the PF Balance via SMS

- First, open the Text Message application on your mobile phone.

- After opening the text messaging application, compose the message “EPFOHO UAN ENG” and send it to “7738299899”.

- You’ll receive your Provident Fund balance details from the other side on your mobile phone.

The message services is available in 09 other languages also which includes: Hindi, Marathi, Tamil, Telugu, Malayam, Bengali, Punjabi, Gujarati & Kannada.

Process to check Provident Fund Balance by giving a missed call

To check the Provident Fund balance through a missed call is an easy task, you just have to drop a call or miss call on “011-22901406” from the mobile number which is connected to the bank account and your Aadhaar Card. After giving a missed call, have patience for a few minutes then you will receive an SMS with your respective Provident Fund details.

PF Balance: Some Links

| Official Website | epfindia.gov.in |

| Download Form | Claiming Withdrawal Form |

| Download Form | Application For Monthly Form |

| Download Form | Death Claim Form |

| Download Form | Transfer Form |

| Download Form | Declaration Form |

| Download Form | LIC Form |